Tax facts you need to know

Topics

Jun 2, 2025

People who work for the City of Kelowna are taxpayers too. We want nice things, but staff also understand that the projects, programs and services presented to Council every year need to add up to value for money.

That approach is a big reason why core services such as transportation and utilities account for more than half of the City’s 2025 Budget.

Police and Fire protection take a little more than 15 per cent of the budget, and Recreation and Culture take another 15 per cent.

That leaves around 11 per cent for the City’s staff and contractors to deliver all the projects, program and services for the year.

Traditionally low rate increases

There is only one taxpayer for federal, provincial and municipal taxes, but local government is the only level that presents its funders with a yearly bill. That’s one reason why the annual property tax bill gets a lot of attention – and the City is always happy to explain what residents are getting for their property taxes.

Contrary to the “fat-cat, gravy train” narrative that comes with the tax season, the City of Kelowna runs a tight ship.

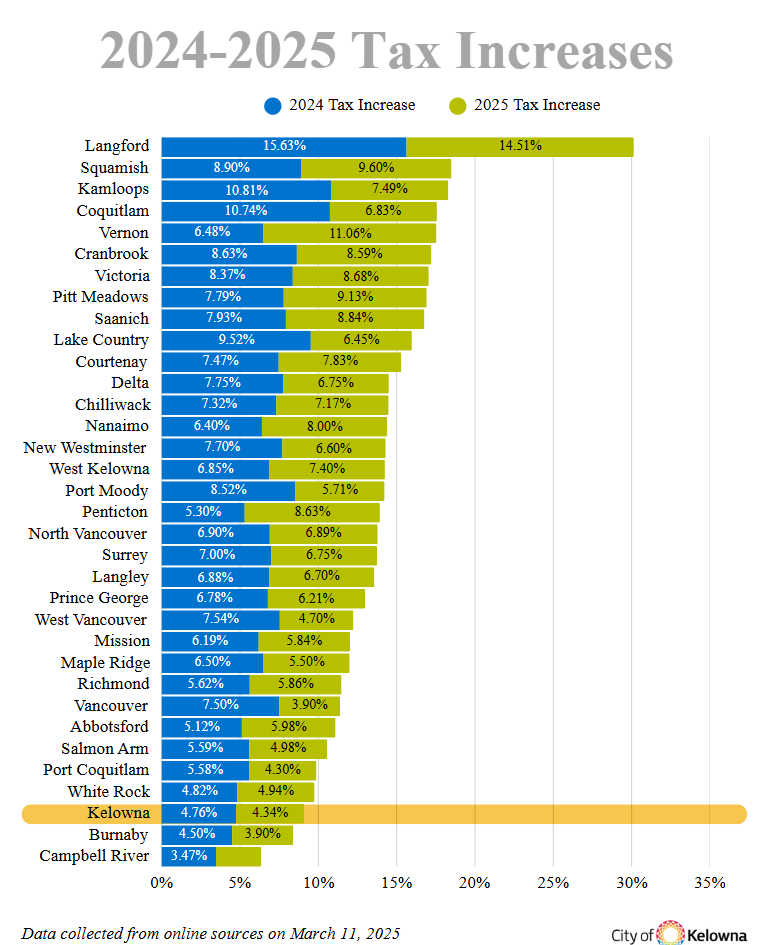

Kelowna has traditionally had one of the lowest tax increases in the province — by design. It takes a steady approach to taxation – not freezing taxes one year, then sharply increasing taxes to make up for those lost revenues in the ensuing years.

Every year, City Council and senior management make tough choices to balance spending between existing services, new or enhanced services, or big capital projects, all while keeping property taxes stable and reasonable. A survey of tax rates among 33 B.C. municipalities found Kelowna has had the third-lowest average rate in the province for 2024-25.

Beyond property taxes

Minimizing our reliance on taxes isn’t just good governance, it’s a City priority. More than 75 per cent of the City’s budget comes from sources other than property taxes — user fees, utility service charges, developer contributions, grants and reserves.

Although the City plans its budget annually, it makes long-term capital investments to keep up with the city's rapid growth. Capital projects support transportation, drainage and wildfire mitigation, public safety, clean drinking water, parks and recreation, and so much more.

As staff and Council continue building Kelowna as the City of the Future, its financial planning reflects a collective commitment to strong management, careful spending and investments in services and projects that set up a bright future for a rapidly growing city.

Visit the City’s website for more about the annual budget, and more about property taxes for 2025.