City budget

Our City Budget

We’re building the City of the Future with stable taxes and smart investments.

As one of Canada's fastest growing communities, Kelowna is in a strong financial position. We boast one of the lowest tax demand increases in the province, healthy investments in capital projects, and an annual budget of about $900 million—all while delivering services that truly matter to our residents. Our budget is the annual blueprint that makes it all possible.

For past budgets, see our publications library.

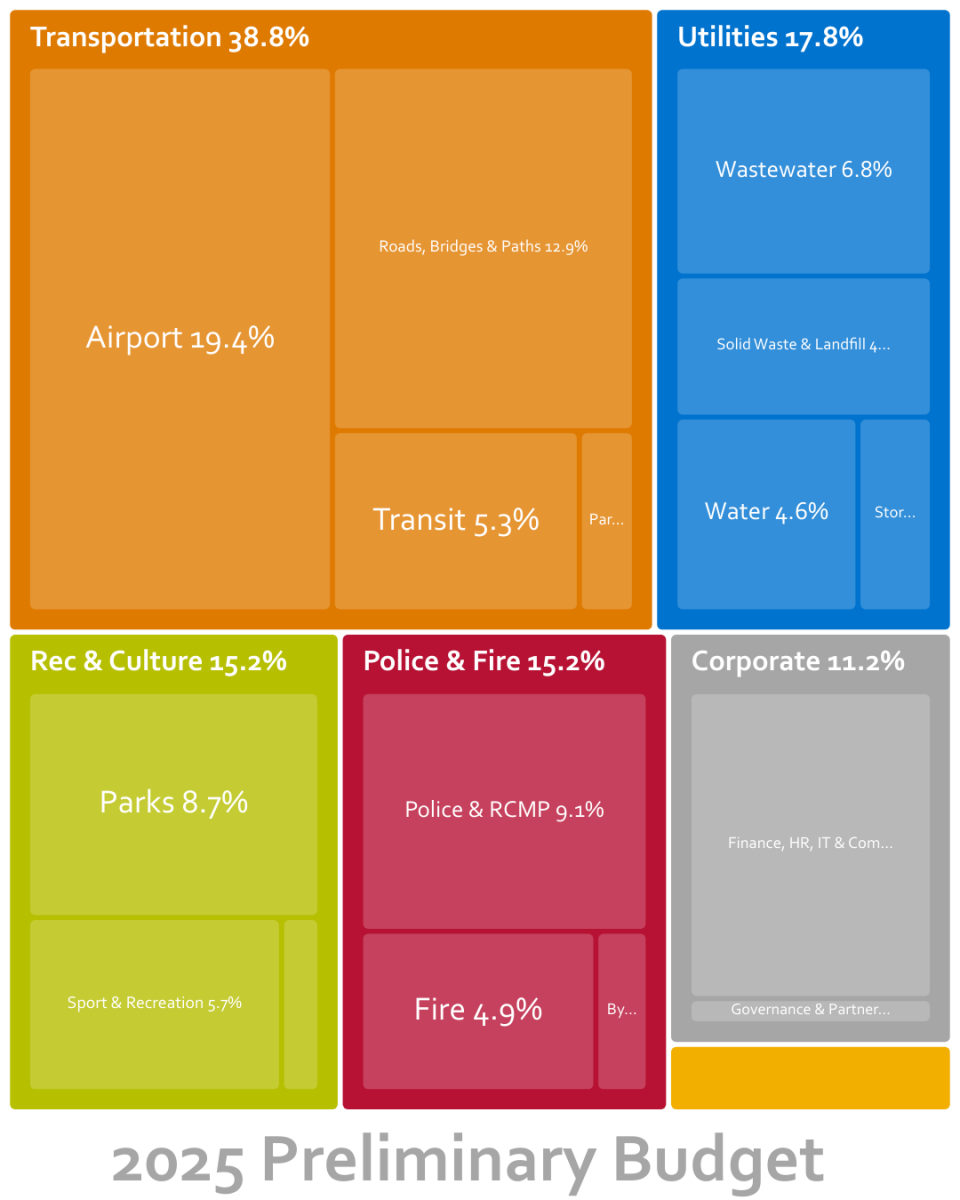

We spend on things that matter

We're taxpayers too, so we spend it like we earned it. Transportation and utilities account for more than half our 2025 Preliminary Budget, while corporate services—regarded as the cost of government—makes up 11 per cent.

Click the infographic to explore the budget.

Low taxes are no accident

Kelowna has one of the lowest tax increases in the province—by design. Each year, City Council and leaders make tough choices to balance spending between existing services, new or enhanced services, or big capital projects, all while keeping property taxes reasonable and the tax increase below 5 per cent. See how we compare with towns and cities across the province.

Compare Taxes

Only 1 in 4 dollars comes from taxes

Minimizing our reliance on taxes isn’t just good governance, it’s a corporate priority. More than 75 per cent of our budget comes from sources other than taxes—like user fees, utility service charges, developer contributions, grants and reserves. See how we've increased non-tax revenues through program cost recovery and other approaches.

See Revenue Sources

Over 40% of our budget is big capital projects

Although we plan our budget on an annual basis, we're making long-term investments to keep up with the city's rapid growth. Capital projects support transportation, drainage and wildfire mitigation, public safety, clean drinking water, parks and recreation, and so much more.

Capital Plan Current Projects

Meet the people behind the services

Ride with Us

City staff deliver essential everyday services. Come along for the ride and see our City at Work.

Meet the Experts

Ever wonder how the City takes care of roads, parks, buildings and other assets? Meet the experts.

Award-Winning Budget

For 23 years in a row, the City of Kelowna has been presented with the Distinguished Budget Presentation Award by the Government Finance Officers Association. We've got the next one covered too.

Plans Behind the Budget

Our budgets are informed by our community vision, Council priorities, and strategies like the Official Community Plan and Transportation Master Plan. See how these plans work together.

A Full Year of Planning

Our annual budget process transforms operating and capital funding requests into real services and projects. Explore our Annual Financial Cycle and see how we balance wants and needs in this video.

Our Performance is Measurable

The quality of our services matters. Look inside our 2025 Budget to see performance indicators by service area. Plus we're working with partners to compare performance across towns and cities.